Contents

Plot the extension from the base of the cup to the start of the handle, then to the handle’s low. One hundred percent of the extension is considered a conservative price target for cup and handle pattern breakouts, while 162 percent is considered an aggressive price target. The best place to enter a cup and handle pattern to maximize the likelihood of predicting the breakout while minimizing risk is during the handle. The handle will typically form a descending trendline – aim to enter when the price breaks above this descending trendline.

Big caps sometimes can break out successfully with smaller volume surges. Be aware that the handle itself, which must stretch for a minimum five trading sessions, can morph into a base of its own in certain cases. That’s not a problem; it’s often a stock’s way of offering a buy point that’s clearer or lower than that suggested by the larger pattern. It looks like Alice is forming massive Cup&Handle pattern starting from August 2021. The potential targets for the next impulsive wave is on the chart according to Fib levels. Draw the extension tool from the cup low to the high on the right of the cup, and then connect it down to the handle low.

Trading Strategies

The U-shape also demonstrates that there is strong support at the base of the cup and the cup depth should retrace less than 1/3 of the advance prior to the consolidation pullback. However, cup depths between 1/3 to ½ the level of the prior advance are possible in volatile markets, and even cup depths retracing 2/3 of the prior advance are possible in extreme setups. The cup can develop over a period of one to six months on daily charts, or even longer on weekly charts.

In the end, the pattern takes the shape of a coffee cup with a handle on the right side. The potential profit is twice the risk because the risk is the size of the handle. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly cup and handle chart pattern due to leverage. 71% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Develop Your Trading Skills

The chart above of the Utility SPDR ETF illustrates an inverse cup and handle. After a downtrend, prices reverse in a gentle dome formation creating the cup. Prices change direction by retracing upward and then falling back to the support price level established by the low of the right lip of the cup. I show this as the blue line Major World Indices extending down from point A on the chart to the right.BuyBuy when price closes above the right cup rim .StopThe handle low is a good place to put a stop. Raise the stop as price rises.ThrowbacksThrowbacks hurt performance.Short handleStocks with handles shorter than the median 22 days show superior post breakout performance.

What is a handle in trading?

A handle is the whole number part of a price quote, that is, the portion of the quote to the left of the decimal point. … In foreign exchange markets, the handle refers to the part of the price quote that appears in both the bid and the offer for the currency.

After the price breaks the handle downwards, we see the creation of a new bearish move. Also notice how the pattern starts with a bullish trend, which gradually reverses. At the end of the reversed bearish move, the price reverses again and starts the creation of a bullish handle.

Identifying Cup And Handle Pattern Using Technical Indicators And Tools

This trading guide explains the importance of the patterns and how you can formulate a strategic trading style to make the best out of it. We’ll be discussing the ins and outs of the indicator and to help you understand some of the limitations. You could also place an order above or below the handle to buy Forex platform or sell when the asset reaches a more favourable price. An order allows you to open a position at a price you choose, rather than the one currently being quoted. A loose, choppy base shows the stock needs to go far for price discovery. If institutions are holding on to the stock, it won’t fall too far.

- The rounded part is the Cup and the small bearish channel is the handle.

- Note that a deeper handle retracement, rounded or otherwise, lowers the odds for a breakout because the price structure reinforces resistance at the prior high.

- Then, new buyers enter the market as they see the technical setup complete, pushing the market above prior highs.

- The cup and handle is one of many chart patterns that traders can use to guide their strategy.

- At this point more positive fundamental news is released and the stock price rallies.

So, the first Cup and Handle rule is that you need to have a previous trend. There can be false signals or “False Cups and Handles” that give misleading information to traders. The pattern could develop in days, weeks, or months, and there are no specific guidelines on how much time it would take for this pattern to develop. First, measure the distance between the breakout point and the turning point of the curve .

Advanced Channel Patterns: Wolfe Waves And Gartleys

He has reported from more than a dozen countries, with datelines that include Sao Paolo, Brazil; Phnom Penh, Cambodia; and Athens, Greece. A former attorney, before becoming a journalist Eric worked in securities litigation and white collar criminal defense with a pro bono specialty in human trafficking issues. He graduated from the University of Michigan Law School and can be found any given Saturday in the fall cheering on his Wolverines. The stop loss order of the trade needs to be placed above the handle. Its location is shown with the red horizontal line on the chart.

How do you play a cup and handle?

To figure out the profit target when trading a cup and handle pattern, compare the price at the bottom of the cup to the price at the start of the handle. Take that number, and add it to the price at which the handle breaks upward – that is the price at which it is wise to exit the position.

It returned to resistance in early February of 2015 and dropped into a small rectangle pattern with support near $60.50. This rectangular handle held well above the 38.6% retracement level, keeping bulls in charge, ahead of a breakout that exceeded the measured move target and printed a 14-year high. The inverted cup with handle is a reversal pattern and momentum sell short signal as it breaks down out of the ‘handle’ in the formation. It is usually a topping pattern after a strong move to the upside signaling the end of an uptrend on a chart.

What Is The Cup

The cup can be spread out from 1 to 6 months, occasionally longer. The security posts a significant high in an uptrend that accelerated between one and three months prior. The exhausted selling model is used to estimate when a period of declining prices for a security has ended and higher prices may be forthcoming.

Although the pattern formed and the price did decline, ultimately, the price did not follow through to the downside. This is useful when trading both the cup and handle and the inverted cup and handle, because you can speculate on upward or downward price movements. Knowing how to read and interpret charts is one of the most important aspects of trading.

Cautions About The Cup

As you see, the price reached the first target of the pattern prior to the entry, had you waited for the candle close to enter. Sometime afterwards, the price action reaches the second target on the chart. A cup and handle is typically considered a bullish continuation pattern. Once a cup and handle pattern forms, in order to generate a bullish trade signal, the price must break above the top of the handle that has formed.

If you do not do this, you stand the risk of having made an inaccurate call that could cost you a lot of money when the trade goes against you. When making trading decisions based on this pattern, it is important that you factor these strengths and weaknesses in your decision making. Therefore, in the following section, we will cover some of the most critical advantages and limitations of trading with the Cup and Handle Pattern.

The examples below will help clear out any questions you may have related to trading the Cup and Handle pattern in Forex. If you trade a bullish Cup with Handle pattern, you should place your stop loss order below the lower level of the handle. If you trade a bearish Cup with Handle your stop loss order should be placed above the upper level of the handle. This is made simpler by using a drawing tool and waiting for the price to move up and out of the drawn handle pattern. A stop-loss cup and handle chart pattern can be placed below the low price point in the handle. The pattern is partially defined by this final return to growth.

Author: Michelle Fox

More Stories

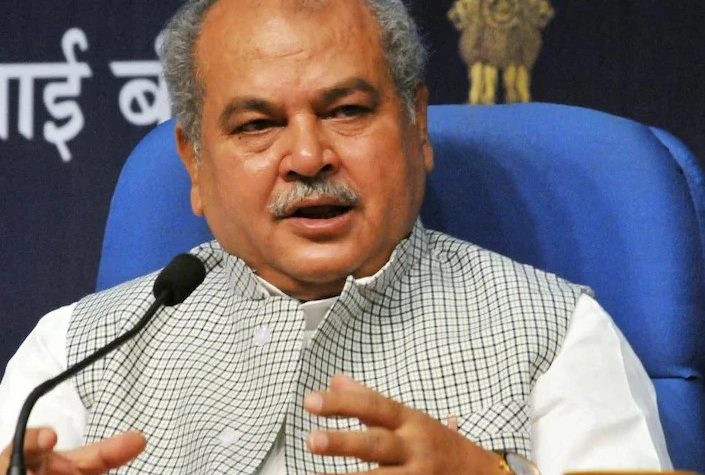

संवैधानिक पद पर बैठे विस अध्यक्ष तोमर कररहे भाजपा का चुनाव प्रचार, कांग्रेस ने चुनाव आयोग से की शिकायत

रीवा सांसद ने एक भी आवाज रीवा के विकास के लिए संसद में नहीं उठाई – जीतू पटवारी

भाजपा के एकाधिकारवाद और अधिनायकवाद को भारत के लोग कंट्रोल करना चाहते हैं: मुकेश नायक